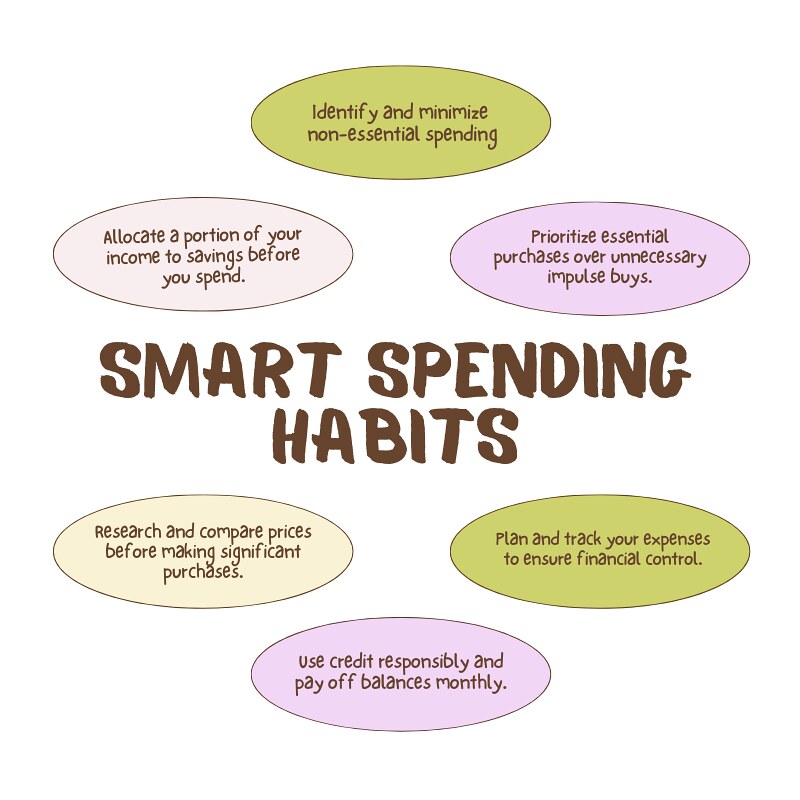

If your wallet took a hit during the holiday season, you’re not alone. But guess what? Now’s the perfect time to turn things around! Let’s kick off 2024 by getting savvy with spending. Starting with budgeting! Who’s with me?

Proper budgeting is the backbone of a good financial situation. Unfortunately, many of us have difficulty tackling this pretty boring chore – after all, who wants to deal with jotting down numbers when we can just handle the bills as they come?

The truth is, not budgeting makes us more likely to spend beyond our means, leaving us unprepared for emergency expenses or for our dream purchases. So how do you motivate yourself to commit to a budget? Here are some tips to keep you on track!

Visualize your financial goals for Budgeting in 2024

Saving up for your own house or a new laptop? Keep a photo of it somewhere you will see it all the time, like a desk corkboard or your kitchen fridge. That will make you think twice before you give in to online sales, and it will be a strong, visible reminder of what you’re sacrificing your quick fix purchases for!

Old School Budgeting Method – Limit your access to money by setting it aside

This method is effective because it limits your on-hand cash. Print out envelopes pre-labeled with what they’re supposed to fund – for example, a blue envelope labeled “Lunch”, a green one labeled “Groceries”, and so on. This will help you set aside money for necessities and keep you from dipping into them. Seeing all the money add up for your dream purchases will also give you more determination to keep saving!

Sure, you could use an app to do this, but this old-school budgeting method physically shows you actually saving your money, as well as the consequences of you taking from these categories for unnecessary purchases – and that’s something no app can do.

Find budget-friendly replacements to manage stress in 2024

One of the biggest causes of overspending is stress buying. Also called emotional buying, this is when you buy something when you’re angry, tired, or sad – even if you don’t need it – just because you want the instant gratification of purchasing something.

Instead of shopping your stress away, find inexpensive or free ways to feel better. Go for a calming walk, or make a hot cup of your favorite tea. Set aside time to watch a feel-good movie. All of these ways are much cheaper than springing for another item of clothing you don’t need!

Journal what you’re saving for, and why you’re saving in Budgeting in 2024

Journal what you’re saving for, and why you’re saving in Budgeting in 2024

Journaling is a good way to put into words what it is that matters most for you, and helps solidify resolve to stick to your budget. Ask yourself why you’re budgeting in 2024, so you can constantly remind yourself what matters more and why you should stay on track. This is especially important when you’re feeling deprived by your strict budget!

Let your friends know you’re budgeting – and limit your time with spendthrifts

If you’re always around people who are too free with their cash, you’ll be tempted to spend. Be honest with your friends about your budgeting – true buddies will help you control spending, and they’ll even remind you if you’re getting out of hand. They’ll also help you get creative about finding ways to have fun on a low budget. After all, friendship doesn’t need a lot of money to have a good time!

Try these five simple ways to help you control your spending. Over time, you’ll notice that you’re saving a lot more every month. Just be patient, trust the process, and try to stay committed using these methods. The journey of a thousand miles begins with a single step, and these five steps will surely take you far!

Journal what you’re saving for, and why you’re saving in Budgeting in 2024

Journal what you’re saving for, and why you’re saving in Budgeting in 2024

Buy me a Coffee

Buy me a Coffee

Buy me a Coffee

Buy me a Coffee